Grande Movimento SILVER

SILVER experimentou um 7.56% em alta movimento no(a) último(a) 10 dias.

GOLD Nível visado: 1845.2400

Canal ascendente identificado em 15-nov-2021 01:00 UTC. Este padrão está ainda em processo de formação. Possível previsão de movimento em baixa para o nível de 1845.2400 no próximo 10 horas.

SILVER Nível visado: 25.1250

Cunha ascendente identificado em 12-nov-2021 17:00 UTC. Este padrão está ainda em processo de formação. Possível previsão de movimento em alta para o nível de 25.1250 no próximo 2 dias.

GOLD Nível visado: 1865.9800

Flâmula identificado em 12-nov-2021 04:45 UTC. Este padrão está ainda em processo de formação. Possível previsão de movimento em alta para o nível de 1865.9800 no próximo 13 horas.

Grande Movimento SILVER

SILVER experimentou um 7.37% em alta movimento no(a) último(a) 9 dias.

SILVER Nível visado: 24.0250

Cunha descendente identificado em 10-nov-2021 08:30 UTC. Este padrão está ainda em processo de formação. Possível previsão de movimento em baixa para o nível de 24.0250 no próximo 14 horas.

GOLD Nível visado: 1817.5674

Cunha ascendente quebrou na linha de suporte em 10-nov-2021 02:00 UTC. Possível previsão de movimento em baixa nos próximos 16 horas para 1817.5674

SILVER Nível visado: 24.5080

Canal ascendente identificado em 09-nov-2021 08:30 UTC. Este padrão está ainda em processo de formação. Possível previsão de movimento em alta para o nível de 24.5080 no próximo 12 horas.

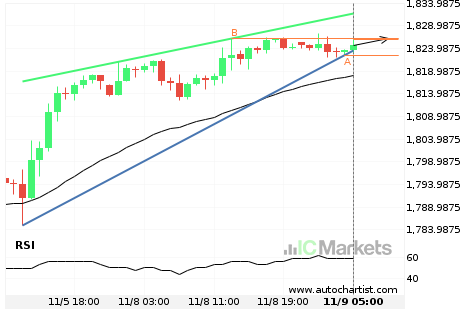

GOLD Nível visado: 1826.1400

Cunha ascendente identificado em 09-nov-2021 05:00 UTC. Este padrão está ainda em processo de formação. Possível previsão de movimento em alta para o nível de 1826.1400 no próximo 12 horas.

SILVER Nível visado: 24.5604

Rompeu Resistência nível de 24.1970 em 08-nov-2021 04:00 UTC